nVentic Big Pharma inventory trends benchmarking report 2022

To see the latest version of this DIO benchmark, see our latest white paper: nVentic Big Pharma inventory trends benchmarking report 2024

2021 was a challenging year for supply chain professionals everywhere, not just in the pharmaceutical industry. Logistics issues abounded, with constrained capacity, ports closed or overwhelmed, HGV drivers in short supply, production delays and labour market shortages.

Such climates provoke bullwhips, since even perceived shortages lead to a scramble to tie in supply and while some run short, others have overstocks. Instead of a good balance between supply and demand, stockpiles develop in some places and shortages appear in others.

By and large, though, the global pharmaceutical supply chain has continued to demonstrate its agility and resilience as production and distribution ramped up at an unprecedented scale to get vaccines to patients while other treatments continued mostly uninterrupted.

2021 saw strong sales growth in the pharmaceutical industry overall after a Covid-restrained 2020. It will maybe best be remembered as the year of the vaccine, but the broader impact of the pandemic has continued to affect both demand and supply sides not just for Covid-related treatments.

Big pharma’s ability to weather the supply chain storm is in no small part thanks to the inventories that it carries for just such contingencies. But inventory is not the only lever available to deliver resilience and having too much of the wrong inventory is a positive burden. In this, our annual look at the inventories of the biggest pharmaceutical manufacturers, we will consider what trends were visible in their inventories in 2021.

Such climates provoke bullwhips, since even perceived shortages lead to a scramble to tie in supply and while some run short, others have overstocks. Instead of a good balance between supply and demand, stockpiles develop in some places and shortages appear in others.

By and large, though, the global pharmaceutical supply chain has continued to demonstrate its agility and resilience as production and distribution ramped up at an unprecedented scale to get vaccines to patients while other treatments continued mostly uninterrupted.

2021 saw strong sales growth in the pharmaceutical industry overall after a Covid-restrained 2020. It will maybe best be remembered as the year of the vaccine, but the broader impact of the pandemic has continued to affect both demand and supply sides not just for Covid-related treatments.

Big pharma’s ability to weather the supply chain storm is in no small part thanks to the inventories that it carries for just such contingencies. But inventory is not the only lever available to deliver resilience and having too much of the wrong inventory is a positive burden. In this, our annual look at the inventories of the biggest pharmaceutical manufacturers, we will consider what trends were visible in their inventories in 2021.

The numbers

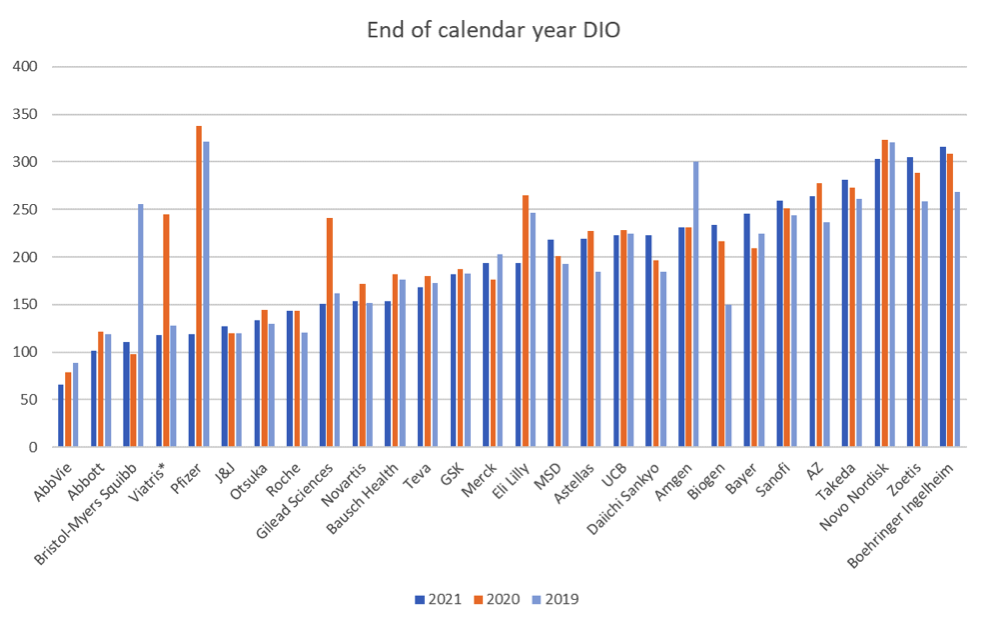

We normally consider median inventories for this group to be a reasonable overall metric of what big pharma inventories have done over the course of the year, but given the nature of DIO and the distribution of the outliers this year, it would be misleading.

(Median DIO for the whole group is down nearly 10% but once you remove those companies with one-off effects skewing the year-on-year DIO comparison, median DIO is up nearly 7%. However, since the companies with one-off effects are predominantly below median, that too is misleading.)

Once all considerations are factored in, underlying inventories expressed as DIO are more or less flat year on year. If you were to treat all companies as one, then aggregate DIO would be significantly down, since annual cost of sales rose at about three times the rate of inventories, but this was due more or less entirely to Covid-19 vaccine sales and once that is accounted for, again overall inventories remained at much the same level as the previous year.

In 2020, 22 out of 28 companies saw their inventories increase, in 2021 it was much more balanced, with 13 showing an increase and 15 a decrease.

(Median DIO for the whole group is down nearly 10% but once you remove those companies with one-off effects skewing the year-on-year DIO comparison, median DIO is up nearly 7%. However, since the companies with one-off effects are predominantly below median, that too is misleading.)

Once all considerations are factored in, underlying inventories expressed as DIO are more or less flat year on year. If you were to treat all companies as one, then aggregate DIO would be significantly down, since annual cost of sales rose at about three times the rate of inventories, but this was due more or less entirely to Covid-19 vaccine sales and once that is accounted for, again overall inventories remained at much the same level as the previous year.

In 2020, 22 out of 28 companies saw their inventories increase, in 2021 it was much more balanced, with 13 showing an increase and 15 a decrease.

Days Inventory Outstanding (DIO) = inventory value/(cost of sales/365). See also the technical notes at the end of this article.

*Viatris DIO in 2019 is Mylan DIO for comparison.

Two good indicators that inventories are not doing their job are shortages and obsolescence. While there are almost always shortages of some medicines in some markets, there is no evidence that shortages worsened in 2021. Indeed, surveys such as the PGEU Medicines Shortages Survey 2021 found that 2021 was the first time in years that shortages did not worsen year on year.

Inventory write offs are an opaque area, since not all companies declare how much they write off each year and the ones that do follow slightly different accounting conventions, making comparison difficult.

However, from those that do declare something in this area, the average amount of inventory being written off each year appears to be slightly up, at 4% in 2021 compared to 3% in 2020. This increase was driven in part by a number of big bets, such as Eli Lilly’s $340m net impairment charge related to Covid antibodies that were produced in response to government demand but ended up not being required.

When you’re dealing with perishable products and responding to extraordinary circumstances, some waste is inevitable, although the number of companies in this report that write off hundreds of millions of dollars’ worth of inventory each year is also symptomatic of more structural problems and is an issue we know several companies listed here are already trying to address. This is an area that nVentic is actively working in. See also our special report on inventory write offs in pharmaceutical manufacturing.

DIO numbers are also subject to significant swings in the event of major acquisitions and other exceptional circumstances. A number of these are visible in this year’s benchmark when you consider the biggest year on year changes. Because acquired inventories are marked up to fair value, it temporarily swells inventory value until such time as the fair value is unwound through cost of sales. Thus you can see the impact of Bristol Myers Squibb’s acquisition of Celgene, Gilead’s acquisition of Immunomedics, and Amgen’s acquisition of Otezla. Viatris was formed by the merger of Mylan and Pfizer’s Upjohn business and we have included Mylan’s 2019 DIO number to show how Viatris is now back at Mylan’s previous inventory levels.

Acquisitions are not the only event that have such a significant impact on DIO. Pfizer’s numbers reflect the impact of the Covid-19 vaccine Comirnaty: annual revenue almost doubled, from nearly $42bn in 2020 to over $81bn in 2021, driving cost of sales to grow more than 250% while inventories only increased by 24%. Having a product with essentially unlimited demand naturally means that it doesn’t hang around in inventory for long. The scale of that demand as a proportion of total production moved Pfizer from one end of the graph to the other in just one year, although it goes without saying that getting the vaccine produced and shipped so fast and at such impressive scale is what really matters. We focus on inventories each year as that is our specialist area of interest, but we hopefully never pretend it is the only or even the most important measure of big pharma’s performance.

Big bets on coming products can also have a material effect. For instance, Biogen’s DIO numbers are still significantly up on 2019, to no small extent due to the disappointing sales of aducanumab, which has left them with large inventories that are gradually going out of date, with 2021 seeing $168m written down, mostly for obsolescence.

And in some cases, different forces cancel each other out. Abbvie’s acquisition of Allergan is barely visible in the charts, helped to no small extent by the runaway success of Humira. Similarly, AstraZeneca’s acquisition of Alexion does not appear to have produced an uplift in DIO despite the fair value still to be unwound and this is probably the impact of AZ’s Covid-19 vaccine Vaxzevria, which whilst modest compared to Pfizer’s, was still large enough to counterbalance the Alexion inventory impact.

One trend that is emerging over the last couple of years is an increase in the spread of DIO numbers. The standard deviation is increasing for the group year on year and 2021 was a prime example, with a majority of companies who reduced inventories in DIO terms already on the leaner side of the chart, while a majority of those who increased inventories already had more to begin with. This is probably an indication of different strategies being followed. We thought this year we would dig deeper into what DIO does and doesn’t show.

Inventory write offs are an opaque area, since not all companies declare how much they write off each year and the ones that do follow slightly different accounting conventions, making comparison difficult.

However, from those that do declare something in this area, the average amount of inventory being written off each year appears to be slightly up, at 4% in 2021 compared to 3% in 2020. This increase was driven in part by a number of big bets, such as Eli Lilly’s $340m net impairment charge related to Covid antibodies that were produced in response to government demand but ended up not being required.

When you’re dealing with perishable products and responding to extraordinary circumstances, some waste is inevitable, although the number of companies in this report that write off hundreds of millions of dollars’ worth of inventory each year is also symptomatic of more structural problems and is an issue we know several companies listed here are already trying to address. This is an area that nVentic is actively working in. See also our special report on inventory write offs in pharmaceutical manufacturing.

DIO numbers are also subject to significant swings in the event of major acquisitions and other exceptional circumstances. A number of these are visible in this year’s benchmark when you consider the biggest year on year changes. Because acquired inventories are marked up to fair value, it temporarily swells inventory value until such time as the fair value is unwound through cost of sales. Thus you can see the impact of Bristol Myers Squibb’s acquisition of Celgene, Gilead’s acquisition of Immunomedics, and Amgen’s acquisition of Otezla. Viatris was formed by the merger of Mylan and Pfizer’s Upjohn business and we have included Mylan’s 2019 DIO number to show how Viatris is now back at Mylan’s previous inventory levels.

Acquisitions are not the only event that have such a significant impact on DIO. Pfizer’s numbers reflect the impact of the Covid-19 vaccine Comirnaty: annual revenue almost doubled, from nearly $42bn in 2020 to over $81bn in 2021, driving cost of sales to grow more than 250% while inventories only increased by 24%. Having a product with essentially unlimited demand naturally means that it doesn’t hang around in inventory for long. The scale of that demand as a proportion of total production moved Pfizer from one end of the graph to the other in just one year, although it goes without saying that getting the vaccine produced and shipped so fast and at such impressive scale is what really matters. We focus on inventories each year as that is our specialist area of interest, but we hopefully never pretend it is the only or even the most important measure of big pharma’s performance.

Big bets on coming products can also have a material effect. For instance, Biogen’s DIO numbers are still significantly up on 2019, to no small extent due to the disappointing sales of aducanumab, which has left them with large inventories that are gradually going out of date, with 2021 seeing $168m written down, mostly for obsolescence.

And in some cases, different forces cancel each other out. Abbvie’s acquisition of Allergan is barely visible in the charts, helped to no small extent by the runaway success of Humira. Similarly, AstraZeneca’s acquisition of Alexion does not appear to have produced an uplift in DIO despite the fair value still to be unwound and this is probably the impact of AZ’s Covid-19 vaccine Vaxzevria, which whilst modest compared to Pfizer’s, was still large enough to counterbalance the Alexion inventory impact.

One trend that is emerging over the last couple of years is an increase in the spread of DIO numbers. The standard deviation is increasing for the group year on year and 2021 was a prime example, with a majority of companies who reduced inventories in DIO terms already on the leaner side of the chart, while a majority of those who increased inventories already had more to begin with. This is probably an indication of different strategies being followed. We thought this year we would dig deeper into what DIO does and doesn’t show.

Understanding DIO benchmarks

As we write every year, DIO is an imperfect metric. It is subject to various accounting decisions and you are not entirely comparing like for like. It is certainly not a case of “low DIO = good, high DIO = bad”.

On the other hand, it is equally true that there is no (inverse) correlation between size of inventories and shortages, so you can’t really argue that high DIO = good, low DIO = bad either. All other things being equal, and availability being as high as desired, the companies with lower DIO have more efficient supply chains than those with higher DIO purely from a cash conversion perspective. The real question, if you wanted to make a genuine like-for-like comparison between companies, is just how equal those other things are.

So what drives differences in DIO between companies? We can divide the main causes into 5 categories:

On the other hand, it is equally true that there is no (inverse) correlation between size of inventories and shortages, so you can’t really argue that high DIO = good, low DIO = bad either. All other things being equal, and availability being as high as desired, the companies with lower DIO have more efficient supply chains than those with higher DIO purely from a cash conversion perspective. The real question, if you wanted to make a genuine like-for-like comparison between companies, is just how equal those other things are.

So what drives differences in DIO between companies? We can divide the main causes into 5 categories:

- Accounting. The two key numbers in calculating DIO are cost of sales (CoS) and inventory value, both of which are influenced by some of the accounting decisions made. There is no suggestion that any company here is doing anything improper, but different approaches to, for example, what to include in CoS, where to apply LIFO, FIFO or weighted average cost in inventory valuations, even whether to capitalize R&D inventories, have an influence on the numbers reported.

- Forecastability. While forecasting is not the only, or even necessarily the most important lever when it comes to inventory management, it is certainly true that the harder it is to predict demand, the likelier it is that you will end up with either too little or too much inventory. A company with lots of new blockbusters with as yet uncertain demand is liable to have bigger inventory imbalances than a company with many more mature products. The impact of big bets is visible in the numbers from time to time.

- Structural. There are a number of decisions made over the medium to long term that influence how much inventory you need. Having long lead times, large batch sizes, constrained manufacturing capacity, few supply options, and so on, means that you need more inventory than if you have short lead times, continuous manufacturing, plenty of spare capacity and multiple supply options. From an optimization point of view these are often considered as the “givens”, but they determine what is possible before those responsible for the day-to-day management of inventory even get started.

- Strategic. There are also situations where companies just choose to hold more inventory. This might be for tax reasons, it might be to ensure supply even in case of major disruption (contingency stocks), it might be to shore up supply of a raw material in short supply, and so on. A lot of these strategic decisions are appropriate in many situations, especially in pharmaceuticals where products are often necessary for the protection of life or quality of life. However, it is also true that not all strategies are good and even with this type of “strategic” inventory (i.e. anything not built based on actual supply and demand constraints), you still have decisions to make concerning the size and location of such inventories.

- Efficiency. While all of the previous 4 factors play a role in how much inventory an organisation has, efficiency is still highly relevant. In our experience most companies, not just in pharmaceuticals, have little to no transparency into what good even looks like when it comes to inventory levels, and their ability to hit the targets they set themselves is heavily compromised by the way inventory is managed and the way decisions affecting inventory are made. A reduction of 20-50% in inventory levels while maintaining or improving service levels is usually possible using just this 5th lever alone.

So while there are several “good” reasons why some companies have more inventories than others, there are also some less good reasons. And for all the differences between the companies in this benchmark in terms of product portfolios and strategies, it is still surprising to the outside observer that a company at one extreme can run its supply chain successfully with barely two months’ average inventory, while one at the other seems to require around 10 months. That is quite a spread for companies in the same industry. It is likely that the big differences (eg 60-100 days vs 250-300 days) are driven by structural and strategic differences at least in part, although you can’t disentangle the reasons for small or large differences just by looking at the benchmark DIO figures.

The other thing that DIO cannot do is tell you how much inventory an organisation should ideally have. To do this you need to work bottom up, looking at the particular qualities of each individual item you stock. These qualities include lead times, demand, variability, forecastability, intermittence, shelf life, seasonality, and so on. Working bottom up gives you an optimal amount of inventory based on your precise situation and is a much better and more useful guide to what good looks like for you. Even if you are following a deliberate strategy of holding surpluses as contingency, there is value in knowing as precisely as possible how much you need for operational purposes before you start layering more on top.

If you really wanted to compare inventory performance between companies, you would therefore want to measure how close each of them is to the optimized inventory profile for their situation. In the absence of such data, DIO gives an approximate flavour of what’s going on. At nVentic we use it as a conversation starter. People are naturally fascinated by benchmarks, although there is a tendency to accept benchmarks when they show you in a favourable light, but to focus more on the limitations of the benchmark itself when they show you in a less favourable light…

The other thing that DIO cannot do is tell you how much inventory an organisation should ideally have. To do this you need to work bottom up, looking at the particular qualities of each individual item you stock. These qualities include lead times, demand, variability, forecastability, intermittence, shelf life, seasonality, and so on. Working bottom up gives you an optimal amount of inventory based on your precise situation and is a much better and more useful guide to what good looks like for you. Even if you are following a deliberate strategy of holding surpluses as contingency, there is value in knowing as precisely as possible how much you need for operational purposes before you start layering more on top.

If you really wanted to compare inventory performance between companies, you would therefore want to measure how close each of them is to the optimized inventory profile for their situation. In the absence of such data, DIO gives an approximate flavour of what’s going on. At nVentic we use it as a conversation starter. People are naturally fascinated by benchmarks, although there is a tendency to accept benchmarks when they show you in a favourable light, but to focus more on the limitations of the benchmark itself when they show you in a less favourable light…

Outlook

The impact of the pandemic over the last two years has led a lot of companies to rethink their supply chain strategies and structures. Risk management is an even bigger consideration than before. While inventory has traditionally played, and will no doubt continue to play, an important role, some effects of the pandemic have highlighted the risk of depending too much on inventory.

Even within an industry like pharmaceuticals, which, like food, benefits from normally steady demand, there have been significant fluctuations on the demand side. Depending on a few suppliers far from home and piling up cheap inventory doesn’t work so well when logistics routes are disrupted and demand becomes less predictable. Developing new sources of supply, especially closer to home, is a trend we can expect to see continue, which has the side benefit of reducing the need for inventory.

The macro-economic environment is also in a period of change, with inflation putting pressure on sales and the cost of capital in many industries, although pharmaceutical companies do not have much to worry about here, with cost of sales low as a percentage of revenue and demand which is generally insensitive to price beyond competition. Investors looking for protection against the effects of inflation are likely to see pharmaceuticals as a safe bet.

While the economics of running a pharmaceutical company will therefore continue to allow companies to operate successfully without improving their inventory management, it doesn’t mean they should. If nothing else, the amount of waste generated by the industry each year, while never entirely avoidable, is already inspiring many to put additional focus on this topic and this is a trend that will hopefully continue.

Even within an industry like pharmaceuticals, which, like food, benefits from normally steady demand, there have been significant fluctuations on the demand side. Depending on a few suppliers far from home and piling up cheap inventory doesn’t work so well when logistics routes are disrupted and demand becomes less predictable. Developing new sources of supply, especially closer to home, is a trend we can expect to see continue, which has the side benefit of reducing the need for inventory.

The macro-economic environment is also in a period of change, with inflation putting pressure on sales and the cost of capital in many industries, although pharmaceutical companies do not have much to worry about here, with cost of sales low as a percentage of revenue and demand which is generally insensitive to price beyond competition. Investors looking for protection against the effects of inflation are likely to see pharmaceuticals as a safe bet.

While the economics of running a pharmaceutical company will therefore continue to allow companies to operate successfully without improving their inventory management, it doesn’t mean they should. If nothing else, the amount of waste generated by the industry each year, while never entirely avoidable, is already inspiring many to put additional focus on this topic and this is a trend that will hopefully continue.

Technical Notes

Benchmark reports for 2018, 2019, 2020 and 2021 can be found on our website.

For a fuller discussion of DIO as a metric, see our Ultimate guide to DIO. All figures from published corporate reports/filings.

Like last year, we have used figures for calendar years for all firms, including those whose financial years are not the calendar years, i.e. Daiichi Sankyo, Takeda and Astellas, by putting together their quarterly reports.

Like in previous years, we have used an estimate of Boehringer Ingelheim’s cost of sales, which they do not publish.

Benchmark reports for 2018, 2019, 2020 and 2021 can be found on our website.

For a fuller discussion of DIO as a metric, see our Ultimate guide to DIO. All figures from published corporate reports/filings.

Like last year, we have used figures for calendar years for all firms, including those whose financial years are not the calendar years, i.e. Daiichi Sankyo, Takeda and Astellas, by putting together their quarterly reports.

Like in previous years, we have used an estimate of Boehringer Ingelheim’s cost of sales, which they do not publish.

Would you like to receive more content like this, direct to your inbox? We publish white papers on a range of supply chain topics approximately once every one to two months. Subscribe below and we will notify you of new content. Unsubscribe at any time.

For our other articles on supply chain responses to Covid-19, see the relevant section on our Insights page.

Would you like to talk to one of our experts? Contact us