Big pharma inventories in a time of Coronavirus

To see the latest version of this DIO benchmark, see our latest white paper: nVentic Big Pharma inventory trends benchmarking report 2024

At the time of writing, early May 2020, the global pharmaceutical industry is mobilised in reaction to the Covid-19 coronavirus. Inventories of medical products have become a hot topic far beyond the pharmaceutical industry itself. We are still in the heart of the crisis, so it is too early to know which parts of the supply chain prove to be most resilient, and which most fragile, but in this white paper we will look at what has happened so far. We will do this both in light of how much inventory the biggest pharmaceutical companies were carrying going into 2020, and what they need to do in the coming months.

Substantial inventories at the start of the year

Let us start with the baseline figures. Going into the start of 2020, substantial inventories were held:

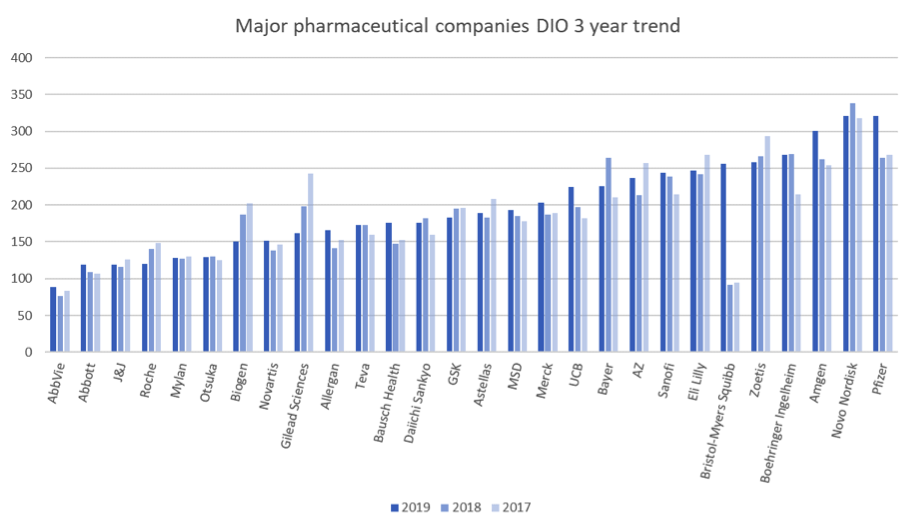

Days Inventory Outstanding (DIO) = inventory value/(cost of sales/365)

DIO is an imperfect comparative metric. See our notes at the end of this paper. Yet a number of trends are of interest:

- There is a very significant spread between how much inventory these companies carry, ranging from about 3 months to almost a year’s worth.

- Both median and mean inventories are up year on year. This group as a whole is holding over $10 billion more in inventory than it was at the end of 2018, although some show consistent year on year reductions in inventory.

- Mergers and acquisitions can cause misleading figures. Bristol Myers Squibb’s acquisition of Celgene, a particularly inventory-heavy company in previous years, has moved them from second place to the bottom quartile, but this is primarily related to the time taken to unwind the fair value purchase price allocation of the acquired inventory. You can expect Bristol Myers Squibb to be back towards the lean end of the benchmark in future years.

Does this matter? Surely keeping the supply of drugs flowing to patients is the most important thing? Well yes, that is precisely why companies hold inventory in the first place. But inventory is also a strategic choice. Building inventory uses capacity, so making too much of some products uses up time and resources that could have been better used making others. And it ties up cash: money invested in inventory is not available for other uses. Perhaps worst of all, with perishable goods like medicines, excessive inventories can and regularly do lead to expired products being written off.

Look again at the graph. Pfizer and Novo Nordisk are carrying nearly a year’s worth of inventory on average. Abbvie around 3 months. Does this imply that Abbvie is more likely to run short of inventory? Or that Pfizer and Novo Nordisk are immune from shortages?

Shortages are a lot harder to track and compare than inventories, since they are not published in the same way. However, if we take as an indicator the USA’s FDA shortage database (1), at the end of April 2020 only 7 of the companies in our benchmark (Abbvie, Allergan, Bristol Myers Squibb, Mylan, Pfizer, Sanofi and Teva) have declared shortages in the USA since the start of 2020, for 25 products across 99 presentations. None of these specifically lists Covid-19 as a reason for shortages, although “increase in demand” is the most common reason given. It is also relevant to mention that the majority of these are not in therapeutic categories directly related to the Coronavirus. The European Medicines Agency, meanwhile, lists no new shortages since the start of 2020 (2).

These shortages are with companies from all across our DIO benchmark. This shows that the companies with most inventories overall seem neither more nor less likely to suffer shortages than those with the least. This seems counter-intuitive. What, after all, is the point of holding so much inventory, if not to assure supply?

Shortages are not a new thing. In the FDA database mentioned, almost half of the total shortages listed as current at the end of April 2020 dated from before the end of 2019. Biopharmaceutical manufacturing processes can be very long and fragile, so despite the industry’s best efforts there are frequently shortages of some items in some places.

It is also important to point out two important features of the benchmark:

Look again at the graph. Pfizer and Novo Nordisk are carrying nearly a year’s worth of inventory on average. Abbvie around 3 months. Does this imply that Abbvie is more likely to run short of inventory? Or that Pfizer and Novo Nordisk are immune from shortages?

Shortages are a lot harder to track and compare than inventories, since they are not published in the same way. However, if we take as an indicator the USA’s FDA shortage database (1), at the end of April 2020 only 7 of the companies in our benchmark (Abbvie, Allergan, Bristol Myers Squibb, Mylan, Pfizer, Sanofi and Teva) have declared shortages in the USA since the start of 2020, for 25 products across 99 presentations. None of these specifically lists Covid-19 as a reason for shortages, although “increase in demand” is the most common reason given. It is also relevant to mention that the majority of these are not in therapeutic categories directly related to the Coronavirus. The European Medicines Agency, meanwhile, lists no new shortages since the start of 2020 (2).

These shortages are with companies from all across our DIO benchmark. This shows that the companies with most inventories overall seem neither more nor less likely to suffer shortages than those with the least. This seems counter-intuitive. What, after all, is the point of holding so much inventory, if not to assure supply?

Shortages are not a new thing. In the FDA database mentioned, almost half of the total shortages listed as current at the end of April 2020 dated from before the end of 2019. Biopharmaceutical manufacturing processes can be very long and fragile, so despite the industry’s best efforts there are frequently shortages of some items in some places.

It is also important to point out two important features of the benchmark:

- A company’s overall DIO figure is just an average. Item by item, each company will have more or less than that, in some cases very much so. This is how a company like Pfizer can be registering shortages despite the significant stocks held on average.

- DIO is only an approximate guide to performance. There may be good reasons why one company needs to hold more inventory than another, in particular the lead times and variability inherent in its supply chain, as well as its mix of products. Our experience at nVentic suggests, however, that all companies have substantial opportunities to reduce inventories and shortages by using optimization techniques.

Will inventories be sufficient?

It is of course too early to say definitively how well supply chains will continue to function. Even if all raw materials supply had completely dried up for everything (which it hasn’t), we are only about 3 months into the crisis, which even the leanest inventory holder in our benchmark holds on average. But if we look at announcements from the big pharma companies themselves, there seems to be limited concerns about shortages, other than relative to potential demand spikes. Inventories only protect you against demand spikes if they are the right inventories. The leanest companies in our benchmark appear to be just as well equipped to deal with what is coming as those at the other end. Agility, the ability to react quickly, is much more useful than inventory when faced with uncertainty.

There are a number of factors influencing the pharma supply chain at the moment, each of which will affect inventories, and each of which will be affected by inventories. These are the major ones:

There are a number of factors influencing the pharma supply chain at the moment, each of which will affect inventories, and each of which will be affected by inventories. These are the major ones:

- Demand has already soared for diagnostic tests for Covid-19 and key drugs related to the use of ventilators, such as anaesthetics, sedatives and paralytics (3).

- At the time of writing, over 260 drugs are being tested to see if they can be beneficially used to treat Covid-19 (4). Demand for those which prove effective can be expected to explode, but that demand might drop again if and when alternatives prove superior. Having a strong candidate in this race could be a mixed blessing for the manufacturers.

- Demand for some drugs, especially those which can only be administered by health professionals, has dropped (5). People are avoiding non-critical medical trips. But in some cases, such as routine vaccines, there is likely to be pent-up demand, which might surge when restrictions on movement are relaxed.

- There is evidence of stockpiling at some nodes in various healthcare systems, driven by concerns about potential shortages (6). This creates bullwhips, with short-term increases in demand being followed by lulls, rippling up the supply chain. This is likely to continue if different treatments prove effective and in the absence of concerted coordination of demand management.

- There has so far been limited disruption to the supply of critical raw materials, in particular related to enforced shut-downs at facilities in India and China (7). The biggest shortages seem by far to be caused by surges in demand rather than supply issues, although such demand surges do of course put the supply chain under increased pressure and many big pharmaceutical companies have warned of potential supply issues if demand is high.

- The search for a vaccine and therapeutics to treat Covid-19 is diverting capacity and efforts from other areas. More than 900 clinical trials for other conditions have so far been suspended or delayed (8). This will have an impact on development timelines and future revenue streams.

Big pharmaceutical firms are also working in a different macro-environment. The pandemic has highlighted the critical role played by the industry, while putting it under significant pressure not only to expedite treatment and vaccines, but also to be seen to be doing the right thing. With many individuals losing their jobs and companies going bust, no one wants to be seen to be profiting from the situation.

In many respects, the pandemic seems to be bringing out the best in the industry. Erstwhile competitors are collaborating both with each other and governmental and other agencies. Significant doses of potentially useful drugs have been made available to those in need. Exclusivity rights have been waived to allow others to support production.

The Covid-19 crisis appears unlikely to prove a financial boon to the pharmaceutical industry. Of course, it is certainly better to be an industry whose products are essential to life in such times. When so many others are going to the wall, survival is an enviable ability in itself.

Instead, what we see from Q1 results is a mixed picture. Some have actually registered a drop in sales, while others fear that increases in sales are artificially supported by stockpiling. And wonderful though a breakthrough vaccine or treatment would be, having something in high demand has a number of downsides from a supply chain point of view.

In many respects, the pandemic seems to be bringing out the best in the industry. Erstwhile competitors are collaborating both with each other and governmental and other agencies. Significant doses of potentially useful drugs have been made available to those in need. Exclusivity rights have been waived to allow others to support production.

The Covid-19 crisis appears unlikely to prove a financial boon to the pharmaceutical industry. Of course, it is certainly better to be an industry whose products are essential to life in such times. When so many others are going to the wall, survival is an enviable ability in itself.

Instead, what we see from Q1 results is a mixed picture. Some have actually registered a drop in sales, while others fear that increases in sales are artificially supported by stockpiling. And wonderful though a breakthrough vaccine or treatment would be, having something in high demand has a number of downsides from a supply chain point of view.

Case study - Remdesivir

At the time of writing, Remdesivir has just been given approval for emergency use by the FDA. It is the first drug to demonstrate clinical benefits for Covid-19 sufferers in a randomized study. Gilead has pledged its entire inventory of finished and semi-finished Remdesivir to the US government for free, to distribute as it sees fit.

Gilead has also announced a ramping up of production and shortening of lead times. It says that the full production lifecycle is normally 12 months, but it is able to reduce this to 6 to 8 months (9). It is planning to have an additional 500 thousand courses available by October 2020, 1 million by December 2020 and “millions” more in 2021. This seems like the right thing to do.

However, consider that the emergency use authorisation is temporary. It could be withdrawn at a later stage. As Remdesivir’s use is rolled out, a lot more data will start to come in. And then consider that it has limited effectiveness. Its main observable effect is to reduce recovery time. This is a good thing in itself, but if one of the other candidate drugs being examined at the moment is shown to be significantly more effective then demand for Remdesivir could slump. Possibly at a point in time where Gilead is already well committed to the production of millions of doses.

There are also reputational risks in play. Gilead has donated around 1.5 million individual doses at no cost. But how will it price future doses? The Institute of Clinical and Economic Review has said that the drug is cost-effective even at $4,500 per course of treatment (10). It seems unlikely that Gilead will price it that high, especially given the criticism it has faced for pricing in the past (when launching its highly effective Hepatitis C drug Sovaldi). But balancing the public health requirements and the need to cover costs will be challenging.

Gilead has also announced a ramping up of production and shortening of lead times. It says that the full production lifecycle is normally 12 months, but it is able to reduce this to 6 to 8 months (9). It is planning to have an additional 500 thousand courses available by October 2020, 1 million by December 2020 and “millions” more in 2021. This seems like the right thing to do.

However, consider that the emergency use authorisation is temporary. It could be withdrawn at a later stage. As Remdesivir’s use is rolled out, a lot more data will start to come in. And then consider that it has limited effectiveness. Its main observable effect is to reduce recovery time. This is a good thing in itself, but if one of the other candidate drugs being examined at the moment is shown to be significantly more effective then demand for Remdesivir could slump. Possibly at a point in time where Gilead is already well committed to the production of millions of doses.

There are also reputational risks in play. Gilead has donated around 1.5 million individual doses at no cost. But how will it price future doses? The Institute of Clinical and Economic Review has said that the drug is cost-effective even at $4,500 per course of treatment (10). It seems unlikely that Gilead will price it that high, especially given the criticism it has faced for pricing in the past (when launching its highly effective Hepatitis C drug Sovaldi). But balancing the public health requirements and the need to cover costs will be challenging.

This is just one example of the sort of challenge that the whole industry is facing. These are extraordinary times. The impact of the Coronavirus on the whole world is so significant that normal considerations of profit and waste can and should be discounted up to a point. It is great that Remdesivir appears to alleviate the symptoms of Covid-19 and that Gilead is ramping up production. If something even more effective comes along, that will be even better, but unless and until that happens the best available course must be followed.

A similar approach is being taken with the development of a vaccine. Many research projects are currently under way and production capacity is being converted or built to produce vaccines in sufficient quantities. The Bill and Melinda Gates Foundation, for instance, has pledged billions of dollars to pay for the construction of vaccine facilities capable of producing a vaccine at scale, knowing that many of those investments will be wasted. This is being done in the hope of significantly compressing the timeline it takes to scale up production after a vaccine has been developed.

A similar approach is being taken with the development of a vaccine. Many research projects are currently under way and production capacity is being converted or built to produce vaccines in sufficient quantities. The Bill and Melinda Gates Foundation, for instance, has pledged billions of dollars to pay for the construction of vaccine facilities capable of producing a vaccine at scale, knowing that many of those investments will be wasted. This is being done in the hope of significantly compressing the timeline it takes to scale up production after a vaccine has been developed.

What more needs to be done with pharma inventories?

If we imagine ourselves at the end of 2020, success will very much be measured – as to a large extent it always is in the pharmaceutical industry – by the lack of shortages, not by the leanness of balance sheets. But this is the essence of inventory optimization. It is precisely by avoiding excesses of the wrong inventory that companies can better avoid shortages of the right inventory. With massive efforts being devoted to battling Covid-19, this balance becomes even more critical to everything else.

So what should pharmaceutical firms be doing to manage their inventories in these times?

So what should pharmaceutical firms be doing to manage their inventories in these times?

- Be wary of forecasts. We argue consistently that too much trust tends to be put in forecasts when it comes to inventory management. At present there is a lot of “noise” in the system, as demand for some products soars or plunges, perhaps temporarily, perhaps more lastingly. Precisely because lead times are typically long, bullwhips are a major risk. Where there are clear reasons for a change in demand then adjustments should be made. For everything else it is likely to be more prudent to plan for a gradual return to normality.

- Do everything possible to shorten lead times, not just for Covid-19 related items. This allows companies to react quicker to changes and necessitates less safety stock.

- Where possible, reduce the sizes of production runs. This too will make companies nimbler and more responsive.

- For all products which are critical to life, consider increasing inventories if necessary to assure supply in the face of potential supply disturbance.

- For all items which are neither Covid-19 related nor critical for life, increase efforts to optimize inventories. Any cash or capacity freed up here may be very useful for other purposes.

- Review and enhance allocation policies. The handling of shortages will come under more scrutiny than ever, so transparent and equitable policies are essential.

2020 is an extraordinary year for the pharmaceutical industry and the supply chain has a critical role to play in how the industry navigates it. Pharmaceutical companies have tended to operate with very high inventories, only partly for good reasons. As the industry plans its way forward over the coming months, inventory is a vital lever it must put every effort into getting right.

Notes

The DIO benchmark:

Benchmark reports for 2018 and 2019, containing analysis of big pharma inventory levels in more normal times, can be found on our website.

All DIO figures calculated from published annual reports for 2017-2019. Most companies in the benchmark use calendar years as financial years, except for Daiichi Sankyo, Takeda and Astellas, where the data used is from the 12 months to 31 March in each year.

The latest Takeda figures, following the integration of Shire, give a false impression due to the full transfer of inventories, but only a quarter’s worth of the increased cost of sales being reflected in the annual report. We have chosen to exclude Takeda from the graph this year since the DIO figure would be misleading.

Some companies classify some of their inventories as “other assets” on their balance sheets. We have included such amounts in our DIO calculations where they are visible in the annual accounts.

We have not included any inventories written down, but since pre-release write downs are so common and so substantial (with one over $900 million in 2019), it would be fair to say that true inventory levels are higher than this benchmark shows.

Boehringer Ingelheim does not report cost of sales, so an estimate has been made based on information in their annual reports and typical ratios from peer companies.

The benchmark includes a selection of the biggest biopharmaceutical companies with published financial reports. If you work for another pharmaceutical company and would like to understand how your organisation compares, please contact us via our website.

For more information on DIO as a metric, see our Ultimate guide to DIO.

Other notes:

The DIO benchmark:

Benchmark reports for 2018 and 2019, containing analysis of big pharma inventory levels in more normal times, can be found on our website.

All DIO figures calculated from published annual reports for 2017-2019. Most companies in the benchmark use calendar years as financial years, except for Daiichi Sankyo, Takeda and Astellas, where the data used is from the 12 months to 31 March in each year.

The latest Takeda figures, following the integration of Shire, give a false impression due to the full transfer of inventories, but only a quarter’s worth of the increased cost of sales being reflected in the annual report. We have chosen to exclude Takeda from the graph this year since the DIO figure would be misleading.

Some companies classify some of their inventories as “other assets” on their balance sheets. We have included such amounts in our DIO calculations where they are visible in the annual accounts.

We have not included any inventories written down, but since pre-release write downs are so common and so substantial (with one over $900 million in 2019), it would be fair to say that true inventory levels are higher than this benchmark shows.

Boehringer Ingelheim does not report cost of sales, so an estimate has been made based on information in their annual reports and typical ratios from peer companies.

The benchmark includes a selection of the biggest biopharmaceutical companies with published financial reports. If you work for another pharmaceutical company and would like to understand how your organisation compares, please contact us via our website.

For more information on DIO as a metric, see our Ultimate guide to DIO.

Other notes:

- Our analysis was done referencing the FDA database as of 28 April 2020.

- European Medicines Agency as of 5 May 2020. Note that this list only includes shortages likely to affect more than one EU member state, so it does not mean there are no new shortages anywhere in Europe since the start of the year. The UK lists 2 drugs from our benchmark companies suffering shortages since the start of 2020, neither obviously Covid-19 related. Most EU member countries have their own shortages lists, most of which are similar to the other countries looked at here – i.e. some shortages in 2020 so far, not just related to Covid-19. Links to individual countries’ lists can be found on the EMA website.

- There is much anecdotal evidence of high demand leading to shortages of some drugs in some settings. Consider this account in the Atlantic from a physician in the US.

- List from Bioworld as of 5 May 2020.

- For example, see this Q1 report from Pfizer, commenting on a drop in new prescriptions.

- See, for example, this Q1 report from AstraZeneca. They prefer the term “short-term inventory increases in the distribution channel” to stockpiling.

- Also referred to in the Q1 2020 report from AstraZeneca listed above (China). There are reports from the Economic Times of temporary shutdowns at Baddi, an important manufacturing hub in India. There are also shutdowns in other parts of the world. India and China are singled out only because of their criticality to the generics and raw materials markets respectively.

- Data from GlobalData as of 5 May 2020.

- For a clear explanation of the challenges involved, see the Gilead website.

- The same report from ICER calculates that a cost recovery price would be in the range of $10 per course.

Would you like to receive more content like this, direct to your inbox? We publish white papers on a range of supply chain topics approximately once every one to two months. Subscribe below and we will notify you of new content. Unsubscribe at any time.

For our other articles on supply chain responses to Covid-19, see the relevant section on our Insights page.

Would you like to talk to one of our experts? Contact us