nVentic Big Pharma inventory trends benchmarking report 2023

To see the latest version of this DIO benchmark, see our latest white paper: nVentic Big Pharma inventory trends benchmarking report 2024

Big Pharma’s inventory position was buffeted by a number of macro-trends in 2022. The direct impact of the Coronavirus receded, as vaccination programs did their job and everyday life began to return to normal over the course of the year. Demand for the vaccine and antivirals dropped from its peak, leading to a certain level of write offs of inventory produced in excess of eventual demand, although the world at large no doubt considers this a price worth paying for the speed with which effective vaccines and medicines were developed and produced.

As demand for Covid medicines and vaccines waned, however, the affect of the lockdown on people’s immune systems led to an unusually high incidence of seasonal illnesses and the latter part of the year saw shortages of many medicines, particularly generics and antibiotics. The widely-reported shortages no doubt also led to stockpiling, exacerbating the situation. So acute was the shortage of liquid ibuprofen, for instance, that the US FDA took the unusual step of allowing medicine manufacturers to compound ibuprofen to distribute in hospitals.

As demand for Covid medicines and vaccines waned, however, the affect of the lockdown on people’s immune systems led to an unusually high incidence of seasonal illnesses and the latter part of the year saw shortages of many medicines, particularly generics and antibiotics. The widely-reported shortages no doubt also led to stockpiling, exacerbating the situation. So acute was the shortage of liquid ibuprofen, for instance, that the US FDA took the unusual step of allowing medicine manufacturers to compound ibuprofen to distribute in hospitals.

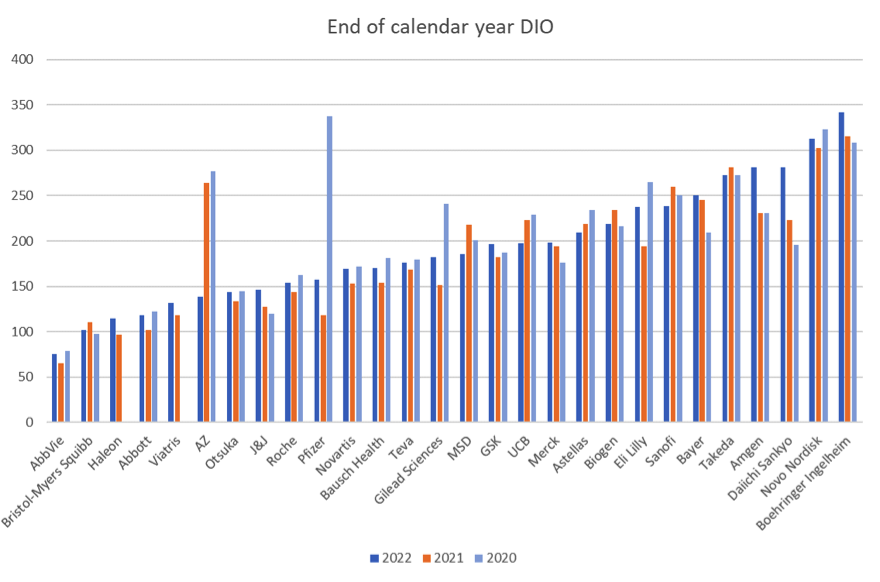

Days Inventory Outstanding (DIO) = inventory value/(cost of sales/365). See also the technical notes at the end of this article.

The numbers

And yet you would struggle to find evidence of an increase in shortages if you just looked at the balance sheets of the major pharmaceutical manufactures. Inventories grew by 10% year on year in aggregate for the companies included in our benchmark, to a combined total of $150bn, while sales grew by just 7%, to $994bn and cost of sales by only 4%, to $311bn.

Inflation drove price increases in raw materials, and this was a contributing factor in the increase in inventory by value, although this increase should ultimately be reflected in cost of sales. Ongoing supply concerns also led many firms to deliberately increase inventories, with the biggest increase (28%) visible in raw materials. The fact that it takes time for an increase in raw materials cost to filter through to cost of sales may indicate that a year-on-year increase in DIO will in part be temporary.

At an individual company level, 20 of the 28 companies saw their DIO increase in 2022, with the mean DIO increasing 5% to 202 and the median up to 197. Thus the increase in shortages cannot be attributed to a lack of inventory. Inventories seem to grow almost every year and yet this does not appear to help protect us from shortages. What is going on?

The main challenge is structural: many manufacturers make to forecast and in large batches, with long lead times and little spare capacity reserved. This makes it extremely difficult to respond quickly to sudden changes in demand. This means that on the one hand they systematically overproduce, with an estimated average ~4% of inventory being written off each year, but still run short of specific medicines from time to time.

Inventory optimization is about having enough of the right inventory. It can seem counter-intuitive, but excesses and shortages often go together.

Inflation drove price increases in raw materials, and this was a contributing factor in the increase in inventory by value, although this increase should ultimately be reflected in cost of sales. Ongoing supply concerns also led many firms to deliberately increase inventories, with the biggest increase (28%) visible in raw materials. The fact that it takes time for an increase in raw materials cost to filter through to cost of sales may indicate that a year-on-year increase in DIO will in part be temporary.

At an individual company level, 20 of the 28 companies saw their DIO increase in 2022, with the mean DIO increasing 5% to 202 and the median up to 197. Thus the increase in shortages cannot be attributed to a lack of inventory. Inventories seem to grow almost every year and yet this does not appear to help protect us from shortages. What is going on?

The main challenge is structural: many manufacturers make to forecast and in large batches, with long lead times and little spare capacity reserved. This makes it extremely difficult to respond quickly to sudden changes in demand. This means that on the one hand they systematically overproduce, with an estimated average ~4% of inventory being written off each year, but still run short of specific medicines from time to time.

Inventory optimization is about having enough of the right inventory. It can seem counter-intuitive, but excesses and shortages often go together.

Inventory waste

As we have written before, companies do not have a standard reporting framework for inventory write offs, so one needs to sort through the various accounting standards to derive an estimate, but inventory write offs continued to be in the range of 4% in 2022, with 12 of our 28 benchmarked companies making no disclosure at all, and the rest ranging from less than 1% up to an eye-watering 15% for Biogen, mostly related to Aduhelm.

That 4% would equate to about $12.5bn of medicines written off at cost in 2022 across the 28 companies considered. While some waste is inevitable in most supply chains and medicine manufacturers need to ensure very high availability, this figure still represents a large waste of capacity and resources. nVentic is working with the Sustainable Medicines Partnership to help create better visibility of this issue and to help address it.

That 4% would equate to about $12.5bn of medicines written off at cost in 2022 across the 28 companies considered. While some waste is inevitable in most supply chains and medicine manufacturers need to ensure very high availability, this figure still represents a large waste of capacity and resources. nVentic is working with the Sustainable Medicines Partnership to help create better visibility of this issue and to help address it.

Outlook

While inventory plays a vital role in assuring supply, cheap cash and high margins also encourage companies to let their inventories grow more than they otherwise should. Those preconditions appear to be at risk heading into 2023. Interest rates are on the rise, with the cost of capital growing from historic lows over the last 10-20 years. And the passing of the Inflation Reduction Act in the US in 2022 is part of an ongoing trend putting pressure on medicine pricing.

When one also considers that inventories in 2022 were consciously increased to mitigate supply issues over the previous 36 months, only some of which are still ongoing, one might expect to see reductions in inventory during 2023.

On the other hand, new medicines for weight loss and Alzheimer’s, as well as RSV vaccines, amongst other new treatments, are creating new demand, with manufacturers ramping up production. Novo Nordisk, for instance, announced in early May 2023 that it needs to restrict access to Wegovy. Holding over 300 days of inventory overall does not help them with the additional capacity required, especially since the same medication, semaglutide, is used by its type-2 diabetes drug Ozempic, which has also been experiencing shortages.

Large-scale bets on new blockbusters are typical of the industry. Once a new treatment is available, we rightly want patients to have access to it. And patent protection also incentivizes manufacturers to maximise sales post-approval. The cost of producing too much inventory can be significant, but with double-digit sales increases a realistic prospect for companies with a new blockbuster, this is usually a risk manufacturers are willing to take.

And yet one feels that at some point something has to give. Excessive inventories are not only environmentally irresponsible and a poor use of capital, but ultimately they also drive up the cost of medicines. Will the tide start to turn in 2023?

When one also considers that inventories in 2022 were consciously increased to mitigate supply issues over the previous 36 months, only some of which are still ongoing, one might expect to see reductions in inventory during 2023.

On the other hand, new medicines for weight loss and Alzheimer’s, as well as RSV vaccines, amongst other new treatments, are creating new demand, with manufacturers ramping up production. Novo Nordisk, for instance, announced in early May 2023 that it needs to restrict access to Wegovy. Holding over 300 days of inventory overall does not help them with the additional capacity required, especially since the same medication, semaglutide, is used by its type-2 diabetes drug Ozempic, which has also been experiencing shortages.

Large-scale bets on new blockbusters are typical of the industry. Once a new treatment is available, we rightly want patients to have access to it. And patent protection also incentivizes manufacturers to maximise sales post-approval. The cost of producing too much inventory can be significant, but with double-digit sales increases a realistic prospect for companies with a new blockbuster, this is usually a risk manufacturers are willing to take.

And yet one feels that at some point something has to give. Excessive inventories are not only environmentally irresponsible and a poor use of capital, but ultimately they also drive up the cost of medicines. Will the tide start to turn in 2023?

Technical Notes

Benchmark reports for 2018, 2019, 2020, 2021 and 2022 can be found on our website.

For a fuller discussion of DIO as a metric, see our Ultimate guide to DIO. All figures from published corporate reports/filings.

Like last year, we have used figures for calendar years for all firms, including those whose financial years are not the calendar years, i.e. Daiichi Sankyo, Takeda and Astellas, by putting together their quarterly reports.

Like in previous years, we have used an estimate of Boehringer Ingelheim’s cost of sales, which they do not publish.

Two major outliers are visible in the charts in 2022:

Pfizer continue to benefit from the impact of Covid-related products on their numbers. In 2022 they wrote off $1.7bn in unused doses of Paxlovid and Comirnaty. However, with annual sales having soared from $42bn in 2020 to over $100bn in 2022, they easily absorbed this loss and the ratio of inventories to cost of sales expressed in DIO continued on a different level to the pre-pandemic years.

AstraZeneca unwound nearly $3.5bn of fair value mark up on acquired Alexion inventories through cost of sales in 2022 and while this has returned their inventories to pre-acquisition levels in the $4-5bn range, the impact on cost of sales has had a significant impact on DIO for 2022.

On the widespread shortages of medicines at the end of 2022, see for instance this article from the World Economic Forum.

Benchmark reports for 2018, 2019, 2020, 2021 and 2022 can be found on our website.

For a fuller discussion of DIO as a metric, see our Ultimate guide to DIO. All figures from published corporate reports/filings.

Like last year, we have used figures for calendar years for all firms, including those whose financial years are not the calendar years, i.e. Daiichi Sankyo, Takeda and Astellas, by putting together their quarterly reports.

Like in previous years, we have used an estimate of Boehringer Ingelheim’s cost of sales, which they do not publish.

Two major outliers are visible in the charts in 2022:

Pfizer continue to benefit from the impact of Covid-related products on their numbers. In 2022 they wrote off $1.7bn in unused doses of Paxlovid and Comirnaty. However, with annual sales having soared from $42bn in 2020 to over $100bn in 2022, they easily absorbed this loss and the ratio of inventories to cost of sales expressed in DIO continued on a different level to the pre-pandemic years.

AstraZeneca unwound nearly $3.5bn of fair value mark up on acquired Alexion inventories through cost of sales in 2022 and while this has returned their inventories to pre-acquisition levels in the $4-5bn range, the impact on cost of sales has had a significant impact on DIO for 2022.

On the widespread shortages of medicines at the end of 2022, see for instance this article from the World Economic Forum.

Would you like to receive more content like this, direct to your inbox? We publish white papers on a range of supply chain topics approximately once every one to two months. Subscribe below and we will notify you of new content. Unsubscribe at any time.

Would you like to talk to one of our experts? Contact us